- January 21, 2026

- cmsadmin

- Category title

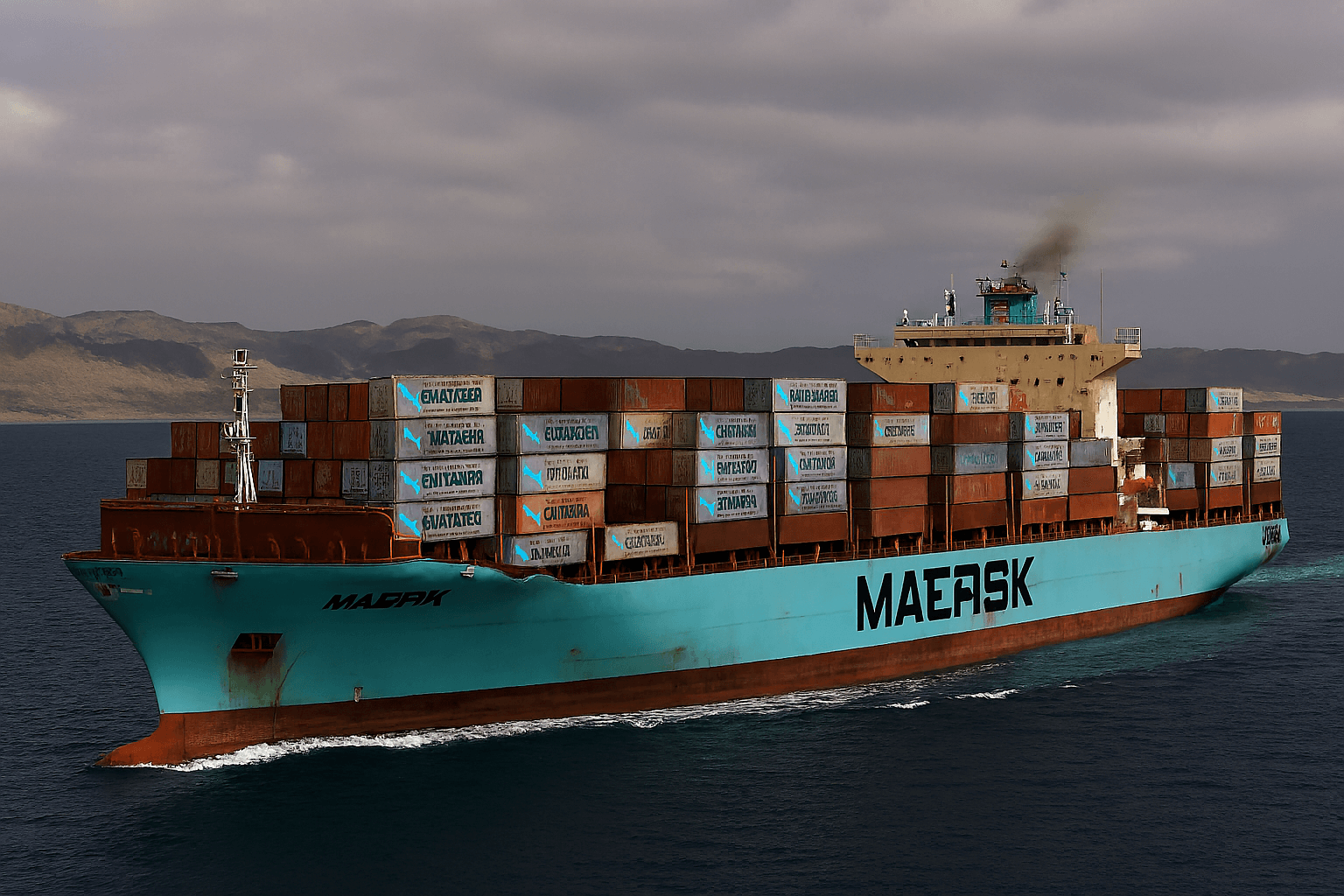

Global container shipping major AP Møller-Maersk has started resuming voyages through the Red Sea and Suez Canal, signalling a potential reopening of one of the world’s most critical maritime corridors following improved security conditions linked to the Gaza ceasefire.

The Danish group, the world’s second-largest container carrier, confirmed that it has initiated a structured return to the trans-Suez route for its Middle East–India to US East Coast (MECL) service. The decision follows what the company described as a period of increased stability in the Red Sea region.

A Turning Point After Prolonged Disruption

Shipping lines have largely avoided the Red Sea since late 2023, when attacks on commercial vessels forced carriers to divert ships around the Cape of Good Hope, adding weeks to transit times and driving up operating costs. The situation began to ease after Yemen’s Houthi group indicated late last year that it would suspend attacks on shipping following the Gaza ceasefire.

Maersk had previously maintained that any full return to the route would depend on clear safety assurances. Earlier this week, the company confirmed that one of its vessels had successfully passed through the Bab el-Mandeb Strait, a key chokepoint in the Red Sea, marking another positive test transit since December.

News Source (Courtesy): Financial Times (FT)

Industry-Wide Implications

Maersk is not alone in reassessing the route. CMA CGM, the world’s third-largest container line, has already restarted Suez transits on one of its India–US services. A broader industry return could significantly reshape global shipping dynamics.

According to market analysts, restoring Red Sea access could:

-

Reduce Asia–Europe transit times by up to two weeks

-

Lower fuel and chartering costs

-

Decrease the total number of vessels required to meet global demand

-

Apply downward pressure on freight rates

Shipping analytics firm Xeneta estimates that a full reopening could make 6–8% of the global container fleet surplus, shifting market power away from carriers and toward shippers.

What This Means for Global Trade

If stability holds, the Red Sea’s reopening could mark the end of more than two years of disruption to global container shipping. However, most carriers are expected to maintain flexible routing strategies, ready to adjust quickly should security conditions deteriorate again.

For shippers, the development offers hope of shorter lead times and easing freight costs, but the industry remains firmly in a wait-and-watch mode as geopolitical risks continue to shape global trade routes.

+++++++++++++++++ END+++++++++++++++++++

Subscribe to newsletter

Subscribe to receive the latest blog posts to your inbox every week.

By subscribing you agree to with our Privacy Policy.

Related Articles

Stay informed with the latest updates and insights from the digital world